|

Issue Number: A-2012-42 IRS Announcement 2012-42: Timelines for Due Diligence and Other Requirements under FATCA

(Source: IRS Guidewire: Issue Number: A-2012-42)

I. Purpose

This announcement outlines (i) certain timelines for withholding agents and foreign financial institutions (FFIs) to complete due diligence and other requirements and (ii) certain additional guidance concerning gross proceeds withholding and the status of certain instruments as grandfathered obligations under sections 1471 through 1474 of the Internal Revenue Code (Code). The Department of the Treasury (Treasury Department) and the Internal Revenue Service (IRS) intend to incorporate the rules described in this announcement in final regulations under sections 1471 through 1474.

II. BACKGROUND

On March 18, 2010, the Hiring Incentives to Restore Employment Act of 2010, Pub. L. 111-147 (H.R. 2847), added sections 1471 through 1474 (chapter 4) to Subtitle A of the Code. These provisions are commonly referred to as the Foreign Account Tax Compliance Act, or FATCA. Chapter 4 requires withholding agents to withhold 30 percent of certain payments to an FFI unless the FFI has entered into an agreement (FFI agreement) with the IRS to, among other things, report certain information with respect to U.S. accounts. Chapter 4 also imposes on withholding agents certain withholding, documentation, and reporting requirements with respect to certain payments made to certain other foreign entities.

On February 15, 2012, the Treasury Department and the IRS published proposed regulations under chapter 4 in the Federal Register (REG-121647-10, 77 Fed. Reg. 9022) (proposed regulations). On May 15, 2012, the IRS held a public hearing on the proposed regulations. On July 26, 2012, the Treasury Department released a model for bilateral agreements with other jurisdictions (in both reciprocal and nonreciprocal versions) under which FFIs would satisfy their chapter 4 requirements by reporting information about U.S. accounts to their respective tax authorities, followed by the automatic exchange of that information on a government-to-government basis with the United States. The model agreement outlines time frames for FFIs in partner jurisdictions to complete the necessary due diligence to identify U.S. accounts. On June 21, 2012, the Treasury Department announced its intent to develop a second model agreement, under which financial institutions in the partner jurisdiction would report specified information directly to the IRS in a manner consistent with the FATCA regulations, supplemented by government-to-government exchange of information on request. The Treasury Department intends to conclude bilateral agreements (“Intergovernmental Agreements”) based on the model agreements.

The Treasury Department and the IRS have received comments identifying certain practical issues in implementing the chapter 4 rules within the time frames prescribed in the proposed regulations. In particular, comments have noted that the chapter 4 status of entity account holders may change during 2013 as FFIs enter into FFI agreements with the IRS, with the result that withholding agents that put in place new account opening procedures by January 1, 2013, could be required to undertake duplicative efforts to verify an FFI’s status as a participating, deemed-compliant, or nonparticipating FFI. Furthermore, comments have indicated that global financial institutions intend to implement uniform due diligence procedures for all affiliates. Accordingly, these comments have suggested aligning the timelines for due diligence for U.S. withholding agents, FFIs in countries with Intergovernmental Agreements, and FFIs in countries without Intergovernmental Agreements in order to significantly reduce administrative burden.

In addition, the Treasury Department and the IRS have received comments requesting that obligations that may give rise to foreign passthru payments, but not to withholdable payments, be treated as grandfathered obligations if such obligations are executed prior to the issuance of final regulations that define foreign passthru payments. Comments also have requested that an obligation to make payments with respect to collateral posted in connection with a grandfathered derivative transaction be treated as a grandfathered obligation. Finally, comments have expressed concern over the treatment of existing financial transactions that may begin to give rise to withholdable payments for purposes of chapter 4 due to the promulgation of regulations under section 871(m) (treating certain payments on notional principal contracts and certain other financial instruments as U.S. source dividends).

In consideration of these comments, the Treasury Department and the IRS intend to issue regulations that modify the rules set forth in the proposed regulations as follows. Unless otherwise defined, terms used in this announcement have the meanings set forth in the proposed regulations.

III. DUE DILIGENCE TIMELINES

A. Timeline for Implementing New Account Opening Procedures and the Definition of Preexisting Obligations

Withholding agents, including participating FFIs and registered-deemed compliant FFIs, generally will be required to implement new account opening procedures by January 1, 2014. Accordingly, the definition of the term “preexisting obligation” (currently set forth in Prop. Reg. §1.1471-1(b)(48)) will be modified in the final regulations to include:

With respect to a withholding agent other than a participating FFI or a registered deemed-compliant FFI: any account, instrument, or contract maintained or executed by the withholding agent prior to January 1, 2014;

With respect to a participating FFI: any account, instrument, or contract maintained or executed by the participating FFI prior to the later of January 1, 2014, or the date that the participating FFI’s FFI agreement becomes effective (the final regulations will provide that an FFI agreement entered into prior to January 1, 2014, will have an effective date of January 1, 2014);

With respect to a registered deemed-compliant FFI:

B. Transition Rules for Completing Due Diligence on Preexisting Obligations

1. Withholding and Documentation for Prima Facie FFIs

Withholding Agents other than Participating FFIs. With respect to preexisting obligations, the final regulations will provide that withholding agents, other than participating FFIs, will be required to document payees that are prima facie FFIs by June 30, 2014. Accordingly, the rule set forth in Prop. Reg. §1.1471-2(a)(4)(ii) will be modified in the final regulations to provide that a withholding agent will not be required to withhold on payments made to a prima facie FFI with respect to a preexisting obligation prior to July 1, 2014, unless the withholding agent has documentation establishing the payee’s status as a nonparticipating FFI. Beginning on July 1, 2014, a withholding agent will be required to treat a payee that is a prima facie FFI as a nonparticipating FFI until the date the withholding agent obtains documentation sufficient to establish a different chapter 4 status of the payee.

Participating FFIs. With respect to a preexisting obligation, the final regulations will provide that a participating FFI will be required to perform the requisite identification procedures and obtain the appropriate documentation to determine whether a prima facie FFI payee is itself a participating FFI, deemed-compliant FFI, or nonparticipating FFI within six months after the effective date of its FFI agreement (that is, by June 30, 2014, for any FFI that enters into an FFI agreement on or before December 31, 2013). The rule set forth in Prop. Reg. §1.1471-4(c)(3) will be modified accordingly. In addition, the final regulations will provide that the presumption rules set forth in Prop. Reg. §1.1471-3(f) will begin to apply to a prima facie FFI payee with respect to a preexisting obligation six months after the effective date of the payor FFI’s FFI agreement.

2. Withholding and Documentation for other Preexisting Entity Obligations

Withholding Agents other than Participating FFIs. With respect to preexisting obligations, the final regulations will provide that withholding agents, other than participating FFIs, will be required to document payees that are entities other than prima facie FFIs by December 31, 2015. Accordingly, the rules set forth in Prop. Reg. §§1.1471-2(a)(4)(ii) and 1.1472-1(b) will be modified to reflect this change. Beginning on January 1, 2016, a withholding agent will be required to treat any undocumented payee that is treated as a foreign entity but that is not a prima facie FFI as a nonparticipating FFI until the date the withholding agent obtains documentation sufficient to establish a different chapter 4 status of the payee.

Participating FFIs. The final regulations will modify the rule set forth in Prop. Reg. §1.1471-4(c)(3) to provide that a participating FFI will be required to perform the requisite identification procedures and obtain the appropriate documentation to determine whether an entity, other than a prima facie FFI, is itself a participating FFI by the later of December 31, 2015, or the date that is two years after the effective date of its FFI agreement. In addition, the final regulations will provide that a participating FFI will not be required to apply the presumption rules (currently set forth in Prop. Reg. §1.1471-3(f)) to such accounts until the day after the date (described above) by which the participating FFI is required to perform the identification procedures and obtain the appropriate documentation.

3. Withholding and Documentation Requirements of Participating FFIs for Preexisting Individual Accounts

Preexisting High-Value Accounts. A participating FFI must perform the requisite identification procedures and obtain the appropriate documentation to identify preexisting individual accounts that are high-value accounts (as described in Prop. Reg. §1.1471-4(c)(8)(i)) by the later of December 31, 2014, or the date that is one year after the effective date of the FFI’s FFI agreement. Accordingly, the final regulations will modify the rule set forth in Prop. Reg. §1.1471-5(g)(3)(i)(B) to provide that after the date described above, a participating FFI must treat any preexisting account that is a high-value account as held by a recalcitrant account holder unless the participating FFI has performed the requisite identification procedures and obtained the appropriate documentation.

Preexisting Accounts other than High Value Accounts. A participating FFI must perform the requisite identification procedures and obtain the appropriate documentation to identify preexisting individual accounts (other than high-value accounts) prior to the later of December 31, 2015, or the date that is two years after the effective date of the FFI’s FFI agreement. Accordingly, the final regulations will modify the rule set forth in Prop. Reg. §1.1471-5(g)(3)(i)(A) to provide that after the date described above, a participating FFI must treat any preexisting individual account, other than a high-value account, as held by a recalcitrant account holder unless the participating FFI has performed the requisite identification procedures and obtained the appropriate documentation.

IV. DUE DATE FOR FIRST REPORT OF A PARTICIPATING FFI WITH RESPECT TO U.S. ACCOUNTS

The final regulations will modify the rule set forth in Prop. Reg. §1.1471-4(d)(7)(v)(B) to provide that a participating FFI will be required to file the information reports with respect to the 2013 and 2014 calendar years not later than March 31, 2015.

V. GROSS PROCEEDS WITHHOLDING

The final regulations will modify the rule set forth in Prop. Reg. §1.1473-1(a)(1)(ii) to provide that the term “withholdable payment” includes gross proceeds from any sale or other disposition occurring after December 31, 2016, of any property of a type that can produce interest or dividends that are U.S. source FDAP income.

VI. CLARIFICATION OF THE SCOPE OF GRANDFATHERED OBLIGATIONS

The final regulations will modify the grandfathered obligation rules to cover the following additional categories of obligations. First, the rule set forth in Prop. Reg. §1.1471-2(b)(2) will be amended to provide that the term “grandfathered obligation” includes any obligation that produces or could produce a foreign passthru payment and that cannot produce a withholdable payment, provided that the obligation is outstanding as of the date that is six months after the date on which final regulations defining the term “foreign passthru payment” are filed with the Federal Register. Second, the term “grandfathered obligation” will include any instrument that gives rise to a withholdable payment solely because the instrument is treated as giving rise to a dividend equivalent pursuant to section 871(m) and the regulations thereunder, provided that the instrument is outstanding on the date that is six months after the date on which instruments of its type first become subject to such treatment. Finally, the term “grandfathered obligation” will include any obligation to make a payment with respect to, or to repay, collateral posted to secure obligations under a notional principal contract that is a grandfathered obligation.

DRAFTING INFORMATION

The principal author of this announcement is Tara Ferris of the Office of Associate Chief Counsel (International). For further information regarding this notice, contact John Sweeney at (202) 622-3840 (not a toll-free call).

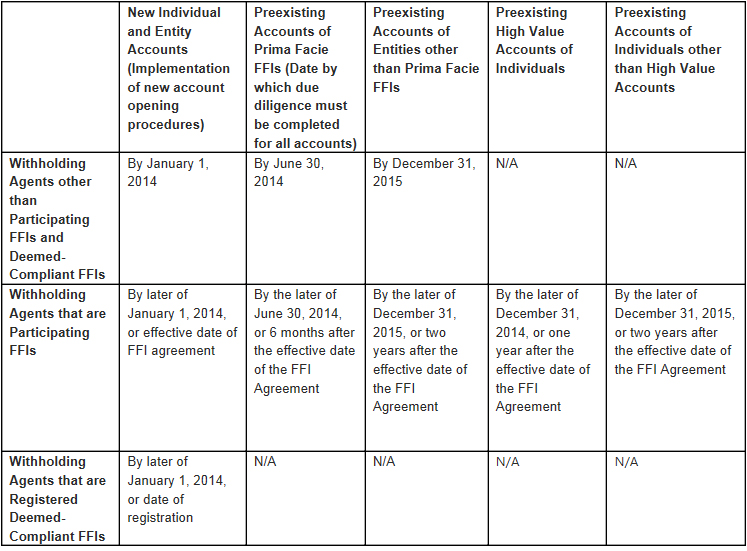

Summary of Timing for Performing Due Diligence Procedures to Identify and Document Accounts

The following table summarizes the dates by which withholding agents and financial institutions must fully implement new account opening procedures to identify account holders and the dates by which withholding agents and financial institutions must complete the review and documentation of all preexisting accounts for purposes of applying the relevant Treasury regulations. The table is intended only as an illustrative tool and therefore should be interpreted consistently with the accompanying Announcement. It is important to emphasize that although the final regulations will provide a reasonable period of time to allow withholding agents to review and document all preexisting accounts, the final regulations will make clear that once a particular account has been documented, for example as a U.S. Account or as a nonparticipating FFI, withholding or reporting, as appropriate, must begin with respect to that account even though the time period for completing the identification and documentation of preexisting accounts may not have expired.

(Source: IRS Guidewire: Issue Number: A-2012-42 October 24, 2012)

Disclaimer: This publication does not, and is not intended to, provide legal, tax or accounting advice, and readers should consult their tax advisors concerning the application of tax laws to their particular situations. This analysis is not tax advice and is not intended or written to be used, and cannot be used, for purposes of avoiding tax penalties that may be imposed on any taxpayer. The information contained herein is general in nature and based on authorities that are subject to change. Parker Tax Publishing guarantees neither the accuracy nor completeness of any information and is not responsible for any errors or omissions, or for results obtained by others as a result of reliance upon such information. Parker Tax Publishing assumes no obligation to inform the reader of any changes in tax laws or other factors that could affect information contained herein.

Parker Tax Pro Library - An Affordable Professional Tax Research Solution. www.parkertaxpublishing.com

We hope you find our professional tax research articles comprehensive and informative. Parker Tax Pro Library gives you unlimited online access all of our past Biweekly Tax Bulletins, 22 volumes of expert analysis, 250 Client Letters, Bob Jennings Practice Aids, time saving election statements and our comprehensive, fully updated primary source library.

Try Our Easy, Powerful Search Engine

A Professional Tax Research Solution that gives you instant access to 22 volumes of expert analysis and 185,000 authoritative source documents. But having access won’t help if you can’t quickly and easily find the materials that answer your questions. That’s where Parker’s search engine – and it’s uncanny knack for finding the right documents – comes into play

Things that take half a dozen steps in other products take two steps in ours. Search results come up instantly and browsing them is a cinch. So is linking from Parker’s analysis to practice aids and cited primary source documents. Parker’s powerful, user-friendly search engine ensures that you quickly find what you need every time you visit Our Tax Research Library.

Dear Tax Professional,

My name is James Levey, and a few years back I founded a company named Kleinrock Publishing. I started Kleinrock out of frustration with the prohibitively high prices and difficult search engines of BNA, CCH, and RIA tax research products ... kind of reminiscent of the situation practitioners face today.

Now that Kleinrock has disappeared into CCH, prices are soaring again and ease-of-use has fallen by the wayside. The needs of smaller firms and sole practitioners are simply not being met.

To address the problem, I’ve partnered with a group of highly talented tax writers to create Parker Tax Publishing ... a company dedicated to the idea that comprehensive, authoritative tax information service can be both easy-to-use and highly affordable.

Our product, the Parker Tax Pro Library, is breathtaking in its scope. Check out the contents listing to the left to get a sense of all the valuable material you'll have access to when you subscribe.

Or better yet, take a minute to sign yourself up for a free trial, so you can experience first-hand just how easy it is to get results with the Pro Library!

Sincerely,

James Levey

Parker Tax Pro Library - An Affordable Professional Tax Research Solution. www.parkertaxpublishing.com

|